In today’s global investment environment, Exchange-Traded Funds (ETFs) have become essential instruments for portfolio diversification, tactical allocation, and cost-efficient exposure to equities, bonds, commodities, and even alternative assets. Whether you’re a professional investor seeking precise tracking or a retail investor trying to understand ETF returns, this article provides a complete ETF analysis tutorial — combining practical financial theory with hands-on application.

For a detailed guide on the different types of ETFs—including equity, bond, sector, commodity, smart beta, and more—please check our other article It’s a must-read for anyone searching for the best type of ETF to invest in 2025, whether you’re a beginner or experienced investor.

What Is an ETF and Why Is It Important to Analyse It?

An ETF is a marketable security that tracks an index, a sector, a commodity, or another asset class, and is traded on a stock exchange much like individual stocks. Analysing an ETF properly is vital because:

- Not all ETFs are created equal.

- Underlying structures differ (physical vs. synthetic replication).

- Costs, liquidity, and risk vary widely.

- Tracking performance can deviate from the benchmark.

How to Analyse an ETF for Long-Term Investment Performance (Step-by-Step)

A strong ETF analysis involves checking its performance, structure, costs, tracking error, and risk. Here’s a clear step-by-step ETF analysis process you can use today.

Formula:

Return = (Final Price – Initial Price) / Initial Price

Example: If an ETF was priced at €100 in June 2024 and is €110 in June 2025:

Return = (110 – 100) / 100 = 0.10 or 10%

For professionals: Use Total Return NAV to include reinvested dividends for more accurate results.

For retail: Think of this as how much your money grew over the year, just like calculating your savings account gain.

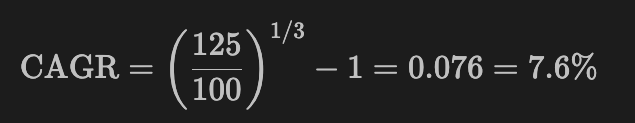

CAGR: Measuring Compounded ETF Growth Rate (H3: “Best Formula to Calculate ETF CAGR”)

For multi-year returns, use CAGR (Compound Annual Growth Rate), which captures the annualised return over time, including compounding.

Formula:

CAGR = (Final Value / Initial Value)^(1/n) – 1

Example:

You invested €100 in an ETF in June 2022. In June 2025, it’s worth €125.

Why it’s important: CAGR shows true annual growth, adjusted for compounding, unlike simple averages.

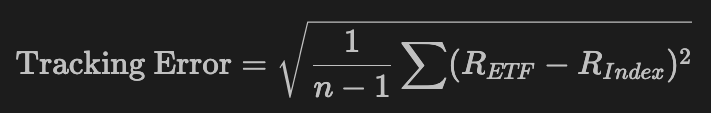

Tracking Error: How Closely Does the ETF Follow the Index?

What Is Tracking Error in ETFs? (Tracking Error ETF Excel Formula)

Tracking error measures how well the ETF mirrors its underlying benchmark. A low tracking error indicates high precision.

A lower tracking error (usually <1%) indicates better performance replication.

Formula:

Excel: Tracking Error = STDEV.S(ETF Return – Index Return)

ETF Cost Analysis: Understanding Total Expense Ratio and Fees

What Is the Total Expense Ratio (TER) and Why It Matters (ETF TER Impact Explained Simply)

TER (Total Expense Ratio) is the annual fee deducted from the fund’s assets, expressed as a percentage.

Formula:

Net Return = Gross Return – TER

Example:

If your ETF grows by 9%, but the TER is 0.30%, your effective return is: 9%−0.30%=8.70%

Look for ETFs with TER below 0.20% for passive exposure (e.g., S&P 500 or MSCI World ETFs).

Low TER ETFs are highly sought after by investors seeking cost efficiency. A TER below 0.20% is considered excellent.

Liquidity Analysis: How to Measure ETF Liquidity

Key Metrics: AUM, Daily Volume, Bid-Ask Spread (How to Check ETF Liquidity)

- Bid-Ask Spread: Smaller is better (ideally <0.15%).

- Average Daily Volume: More volume = easier to buy/sell without moving price.

- Assets Under Management (AUM): Larger funds (>€500 million) tend to be more stable.

To find these metrics, use tools like:

- JustETF.com

- ETF provider factsheets (iShares, Vanguard, Lyxor)

Risk Analysis: Volatility and Sharpe Ratio Explained

What Is ETF Volatility? “ETF Volatility Excel Formula)

Volatility is the standard deviation of returns. It shows how much the ETF’s price moves.

Excel Formula: =STDEV.S(Returns)

Sharpe Ratio: Best Risk-Adjusted Return Metric (Sharpe Ratio ETF Calculation)

A Sharpe ratio above 1 is considered good; above 2 is excellent.

Formula: Sharpe = (Average Return – Risk-Free Rate) / Standard Deviation

Evaluate Replication Method and Tax Efficiency

- Physical Replication ETFs own real assets.

- Synthetic ETFs use swaps; lower tracking error but higher counterparty risk.

- UCITS-Compliant ETFs (especially Ireland-domiciled) offer tax benefits for EU investors.

Always check factsheet, KIID document, and domicile before investing.

Excel Formula Summary for ETF Performance and Risk Analysis

Here’s a practical table for use in your Excel models:

| Name | Excel Formula |

|---|---|

| Return | =(Final – Initial)/Initial |

| CAGR | =(Final/Initial)^(1/Years) – 1 |

| Tracking Error | =STDEV.S(Returns_Diff) |

| TER Impact | =Gross Return – TER |

| Sharpe Ratio | =(AVERAGE(Returns) – RiskFree) / STDEV.S(Returns) |

| Volatility | =STDEV.S(Returns) |

Article Topics:

- Best way to evaluate ETF performance

- Calculating ETF volatility in Excel

- Complete guide to ETF research

- Comprehensive ETF analysis guide

- Difference between physical and synthetic ETFs

- ETF analysis tutorial 2025

- ETF cost analysis explained

- ETF due diligence checklist

- ETF investing for retail investors

- ETF investment analysis for beginners

- Excel formula for ETF CAGR

- How to analyse ETF returns

- How to check ETF liquidity

- How to compare ETF performance

- Understanding ETF tracking error